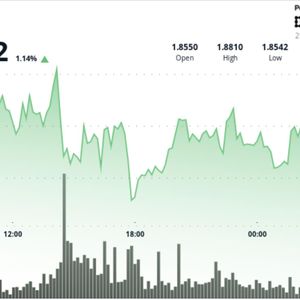

Ethereum price remained below the important support level at $3,000 as demand for the coin eased modestly. ETH dropped to a low of $2,935 on Wednesday, down sharply from the year-to-date high of $4,945. This article provides an ETH price prediction and what to expect in the near term. Ethereum price prediction The daily chart shows that the ETH price has plunged in the past few months. It has crashed from the year-to-date high of $4,945 to the current $2,2935. The token formed a death cross pattern as the 50-day and 200-day Exponential Moving Averages (EMA) crossed each other on November 23, confirming the ongoing bearish breakdown. ETH price has formed a bearish flag pattern, which is made up of a vertical line and an ascending channel. It has now moved below the lower side of the ascending channel. Ethereum token has also dropped below the 50% Fibonacci Retracement level. It has moved below the Ichimoku cloud and the Supertrend indicators. The token has moved below the Strong, Pivot, and Reverse level of the Murrey Math Lines. Therefore, the most likely scenario is where the token continues falling, potentially to the next key support level at $2,500. This is an important level as it was the ultimate support of the Murrey Math Lines and also the psychological level. A move below that level will point to more downside, potentially to the psychological point at $2,000. On the other hand, a move above the key resistance level at $3,437, the bottom of the trading range. Such a move will push it to the year-to-date high of $4,960. Ethereum price chart | Source: TradingView ETH price has bullish catalysts as headwinds remain Ethereum price is facing some major headwinds that may push it lower in the near term. One of them is the ongoing crypto market crash that has affected Bitcoin and other altcoins. Indeed, for the first time in year, Bitcoin has crashed as other assets like gold, silver, and the S&P 500 jumped. Ethereum is also facing the challenge of the ongoing altcoin season weakness. Data compiled by CMC shows that the Altcoin Season Index has dropped sharply in the past few months. Meanwhile, demand for Ethereum ETFs has waned in the past few weeks. These funds shed over $10.9 million in assets this week, bringing the cumulative monthly outflow to $510 million. The funds shed over $1.42 billion in assets last month. Additionally, the volatility may jump sharply in the coming days as investors prepare for a major options expiry. Over $3 billion worth of expiry will happen on Friday, and in most cases, this is usually accompanied by volatility. Still, despite all this, the Ethereum price faces some major tailwinds that may boost its performance in the long term. Its supply in exchanges has dropped to a multi-year low, while its market share in key industries like decentralized finance, stablecoins, and real-world asset (RWA) tokenization has grown. Its dominance has grown even as competition rose. Also, while the Ethereum ETFs have had outflows recently, the reality is that they have added over $12 billion in the less than 2 years, which iss an encouraging number. The post Ethereum price prediction as ETH forms alarming patterns appeared first on Invezz