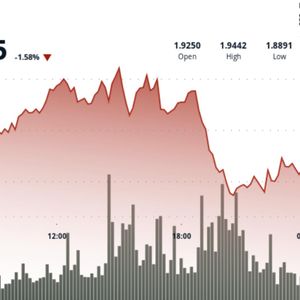

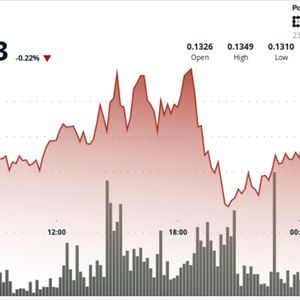

Bitcoin is once again attempting to reclaim the $90,000 level, as bulls cautiously rebuild a recovery narrative after weeks of volatility and heavy selling pressure. While sentiment remains fragile and many investors are still positioned defensively, recent price stabilization has opened the door for a short-term upside scenario. Rather than relying on optimism alone, analysts are increasingly pointing to structural indicators that suggest the balance of risk may be shifting. According to a report by on-chain analyst Axel Adler, Bitcoin’s current setup shows tactical upside potential when viewed through the combined lens of market regime indicators and derivatives liquidation dynamics. Adler highlights that Bitcoin’s Regime Score has recently transitioned into the +15 to +30 zone, a range that has historically delivered positive average returns. This zone represents an early recovery phase, where downside momentum has faded but euphoria has not yet returned, often creating favorable conditions for asymmetric upside. At the same time, derivatives data show a clear dominance of short liquidations, meaning that recent price moves have forced bearish positions to close. This creates mechanical buying pressure, which can amplify upward moves even in the absence of strong spot demand. Together, these signals suggest that Bitcoin’s current attempt to reclaim $90,000 is not purely speculative but supported by an improving internal market structure. Regime Score and Liquidations Point to Tactical Upside Adler explains that Bitcoin’s composite Regime Score aggregates multiple market dimensions into a single framework, including taker imbalance, open interest pressure, funding rates, ETF flows, exchange flows, and price trend. The result is a unified indicator ranging from −100 to +100, designed to capture shifts in market structure rather than short-term noise. Currently, the Regime Score stands at +16.3, placing Bitcoin in the upper part of the neutral zone, defined between +15 and +30. Backtesting data for 2025 shows that this specific subzone has historically delivered average returns of around +3.8% over a 30-day horizon. This contrasts sharply with the −15 to 0 zone, where expected returns were negative, averaging -1.5% over seven days. Importantly, the indicator has recently rebounded from a bearish extreme, after dropping to −27 just a week ago, signaling a structural recovery rather than a random bounce. Adler highlights a critical nuance: transitions into the formal bull regime above +30 have historically coincided with local tops, often followed by negative short-term returns. This makes the current +15–30 range more attractive for tactical positioning, while aggressive accumulation above +30 may carry elevated risk. This view is reinforced by derivatives data. The long/short liquidation dominance oscillator has turned negative at −11%, indicating a surge in forced short closures, while its 30-day average remains positive. With long liquidation dominance at just 44%, short liquidations are clearly prevailing, providing additional mechanical fuel for upside. Bitcoin Tests Key Support as Volatility Compresses Bitcoin is currently trading around the $90,000 area after a sharp corrective move from recent highs, and the chart highlights a market at an important inflection point. Following the breakdown from the $105,000–$110,000 range, BTC experienced a swift decline that pushed the price below the short- and medium-term moving averages. The blue and green moving averages have rolled over, confirming a loss of upside momentum and signaling a shift toward a more defensive market structure. However, price is now stabilizing just above the psychologically critical $88,000–$90,000 zone, which has acted as a reaction level over recent sessions. This area aligns closely with prior consolidation and represents a short-term support cluster where buyers are attempting to regain control. Notably, selling pressure appears to be moderating, as the most aggressive downside move has already occurred, and recent candles suggest consolidation rather than continuation. The red long-term moving average remains well below the current price, indicating that Bitcoin is still structurally above its broader trend support. This reduces immediate downside risk, unless the $88,000 region fails decisively. Volume has also tapered off compared to the sell-off peak, suggesting that panic-driven liquidation may be subsiding. In this context, Bitcoin appears to be transitioning from an impulsive downside into a stabilization phase. A sustained hold above $90,000 would strengthen the case for a relief rally, while a breakdown below support would reopen the door to deeper retracements. Featured image from ChatGPT, chart from TradingView.com

![[LIVE] Crypto News Today: Latest Updates for Dec. 23, 2025 – Trump Token is Down 21% This Month as Multiple Altcoins Hit Fresh Lows [LIVE] Crypto News Today: Latest Updates for Dec. 23, 2025 – Trump Token is Down 21% This Month as Multiple Altcoins Hit Fresh Lows](https://resources.cryptocompare.com/news/52/56213761.jpeg)